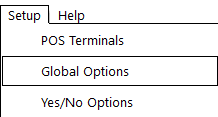

Go to Set up > Global Options > Accounting

Select ‘MYOB AccountRight Live’ from the Accounting package drop down list

Enter:

It is essential you do not have any ‘stray’ Account Codes left in this screen before you begin (press the ‘Clear All’ button if you do).

Note!

Ensure all required accounts are marked as active in MYOB prior to proceeding.

This can only be done via a manual process, by opening each account individually.

Click ‘Get Accounts’. If you have it set up correctly, you will be asked to log in to your MYOB account:

You will then be prompted to allow access to your MYOB account. To do this, select ‘Allow access’.

Tip!

Once an application (such as Idealpos) is linked to MYOB via the API method, there are no obvious links on MYOB's website that allow you to revoke an application's access.

If you need to revoke an application's API access to MYOB, you can visit https://secure.myob.com and login using your Username and Password.

Then press the "Revoke Access" button next to the application you want to revoke access to.

Once access has been revoked, you will need to re-establish the connection (e.g. to connect Idealpos to MYOB, press the "Get Accounts" button and login using your Username and Password).

The available accounts list will now appear on the right-hand side.

‘Drag and Drop’ the GL Account Codes into the empty boxes on the left.

Note!

You will note that you cannot “type” the codes, you must drag-and-drop.

This will ensure we get the underlying GUIDs correctly.

In the table below, is an example of how General Ledger Accounts are linked to Idealpos. Please seek professional advice from your Accountant or Bookkeeper to help you choose the correct GL Account to link to the POS Functions.

|

|

POS Function |

MYOB Account Type |

MYOB Account Code |

Description |

|

Cash |

Tender |

Asset |

1-1180 |

Un-deposited Funds |

|

Points |

Tender |

N/A |

|

Point Redemptions are not sent to MYOB. |

|

MasterCard |

Tender |

Asset |

1-1188 |

EFTPOS |

|

Amex |

Tender |

Asset |

1-1189 |

American Express |

|

Diners |

Tender |

Asset |

1-1160 |

Diners |

|

EFTPOS |

Tender |

Asset |

1-1188 |

EFTPOS |

|

Account |

Tender |

Asset |

1-1200 |

Trade Debtors |

|

Lay-By |

Tender |

Liability |

2-1800 |

Lay-By |

|

Gift Voucher |

Tender |

Liability |

2-1700 |

Gift Voucher |

|

Food |

Sales Category |

Income |

4-1100 |

Sales, Food |

|

Beverage |

Sales Category |

Income |

4-1200 |

Sales, Beverage |

|

Functions |

Sales Category |

Income |

4-1300 |

Sales, Functions |

|

Tips In |

Received on A/c |

Expense |

6-2020 |

Tips In/Out |

|

Paid In |

Received on A/c |

Expense |

6-2010 |

Paid In/Out |

|

Gift Vch Sale |

Received on A/c |

Liability |

2-1700 |

Gift Voucher |

|

Tips Out |

Paid Out |

Expense |

6-2020 |

Tips In/Out |

|

Paid Out |

Paid Out |

Expense |

6-2010 |

Paid In/Out |

|

Rounding |

Rounding |

Expense |

6-1950 |

Rounding |

|

Variance |

Variance |

Expense |

6-1960 |

Variance |

|

Account Adjustment |

Account Adjustment |

Expense |

6-1970 |

Account Adjustment |

|

Lay-by Adjustment |

Lay-by Adjustment |

Expense |

6-1980 |

Lay-by Adjustment |

|

Lay-By Cancellation |

Lay-By Cancellation |

Income |

4-4950 |

Lay-by Fee |

|

Purchases |

Purchase Category |

Cost of Sales |

5-1000 |

Cost of Sales, Purchases |

|

Wine |

Purchase Category |

Cost of Sales |

5-2000 |

Cost of Sales, Purchases |

|

Spirits |

Purchase Category |

Cost of Sales |

5-3000 |

Cost of Sales, Purchases |

|

Freight |

Purchase Category |

Cost of Sales |

5-9100 |

Cost of Sales, Freight |

|

Admin Fees |

Purchase Category |

Cost of Sales |

5-9200 |

Admin Fees |

|

Trade Creditors |

Trade Creditors |

Liability |

2-1200 |

Trade Creditors |

|

GST Holding |

Accounts – Cash Basis |

Liability |

2-1340 |

GST Holding Account |

|

GST Collected |

GST Collected on Sales |

Liability |

2-1310 |

GST Collected |

Once you have set up all your accounts and settings, you can start testing all of the various combinations of events that happen in POS.

You will notice that once you start sending data over to MYOB, we show a bit of progress feedback down the bottom of the screen:

This is because MYOB has no “bulk” way of sending transactions, it is unfortunately quite slow.